Latest News: On July 21, Bayport Polymers, a joint venture between Total Energy and Borealis

LLC) announced that its 1 million ton/year ethylene cracker was officially put into operation.

The nearly $2 billion project is being built at Total Energy’s refinery in Port Arthur, Texas. Ethylene produced by the cracker will be used as feedstock to supply Baystar’s existing polyethylene (PE) plant, as well as the new Borstar® Technology polyethylene plant currently under construction in the Bayport area.

Recent progress of domestic large ethylene projects:

●On July 27, Qinzhou City and PetroChina Guangxi Petrochemical Company signed an investment agreement for PetroChina Guangxi Petrochemical Refining and Chemical Integration Transformation and Upgrading Project. The project is to build 1.2 million tons/year of ethylene and downstream units on the basis of Guangxi Petrochemical’s existing primary crude oil processing capacity of 10 million tons/year, so as to realize the transformation and upgrading of refining and chemical integration. The project is located in the Petrochemical Industrial Park of Qinzhou Port Area of Guangxi Pilot Free Trade Zone, with a total investment of about 30.5 billion yuan.

●On July 2, Sinopec Hainan Refining & Chemical’s 1 million t/a ethylene and refining expansion project started mid-term delivery and entered the stage of preparation for production. The project is located in Yangpu Economic Development Zone. It is a key project of Hainan Province and Sinopec, with a total investment of over 28 billion yuan. After completion, it will promote the development of downstream industries of over 100 billion yuan. It is reported that the main projects involved in the mid-term delivery include 3 sets of main units and 14 sets of supporting projects, including pyrolysis gasoline hydrogenation unit, aromatics extraction unit, and light hydrocarbon recovery unit.

●On March 16, the civil engineering of Sinopec Tianjin Nangang Ethylene Project started. The project has a total investment of over 30 billion yuan, with a 1.2 million ton/year ethylene cracking unit as the leader, and the industrial chain is extended to build a number of high-end new material units such as alpha-olefin and ultra-high molecular weight polyethylene. Among them, 11 units use Sinopec Advanced technology with independent intellectual property rights, the construction period is about 22 months. The project cluster is expected to be completed in 2025.

The world’s ethylene production capacity will continue to grow rapidly

In 2021, as the COVID-19 epidemic eases and the economy recovers, the global ethylene market demand will get rid of the sluggish situation in 2020 and resume growth rapidly. According to the statistics of China National Petroleum Corporation Economic and Technological Research Institute (hereinafter referred to as “CNPC Economic Research Institute”), the world’s new ethylene demand in 2021 will be about 8.5 million tons/year, a year-on-year increase of 146.4%, and the total ethylene demand will reach 180 million tons/year; The newly added ethylene production capacity reached 13.854 million tons/year, and the total ethylene production capacity reached 210 million tons/year, of which 67% came from China.

Growth of world ethylene production capacity in 2021 tons/year

Source: CNPC Economic Research Institute

The CNPC Economic Research Institute predicts that in 2022, the world will add about 13 million tons of ethylene production capacity per year, and the new production capacity will mainly come from China, the United States and India. Among them, the United States will add 3.3 million tons/year of ethylene production capacity, including Exxon Mobil and SABIC will jointly build the world’s largest ethane cracker in Texas, with a production capacity of 1.8 million tons/year, and Shell Chemical in Monaca

1.5 million tons/year unit of PA. In the next 2 to 5 years, the main expansion areas of ethylene in the world will still be Northeast Asia, the United States, and the Middle East.

The total domestic ethylene production capacity exceeded 40 million tons/year

According to the statistics of CNPC Economic Research Institute, 2021 will be the year with the largest number of production capacity completed and put into operation in the history of China’s ethylene industry. The raw material ethylene capacity is expanded by 3.25 million tons per year, and the coal methanol-based ethylene capacity is expanded by 600,000 tons per year. Among them, the production capacity of the gas-based route has developed rapidly, using both overseas ethane and domestic ethane resources, and the new capacity has increased by 1.25 million tons per year compared with 2020; the coal/methanol-based route is affected by the national “two-carbon” policy, and the production capacity has increased significantly slow down.

By the end of 2021, China’s total ethylene production capacity reached 43.68 million tons per year, a year-on-year increase of 24.2%, continuing to maintain a rapid growth trend. The production capacity of ethylene downstream products has been greatly increased at the same time. The new domestic production capacity of polyethylene is 5.25 million tons/year to 26.11 million tons/year, the new production capacity of ethylene glycol is 4.18 million tons/year to 20.06 million tons/year, and the new production capacity of styrene is 276.3 million tons/year. 10,000 tons/year to 14.5 million tons/year, and new ethylene oxide production capacity of 1.71 million tons/year to 6.49 million tons/year.

China’s new production capacity of ethylene and downstream products in 2021 10,000 tons/year

Source: CNPC Economic Research Institute

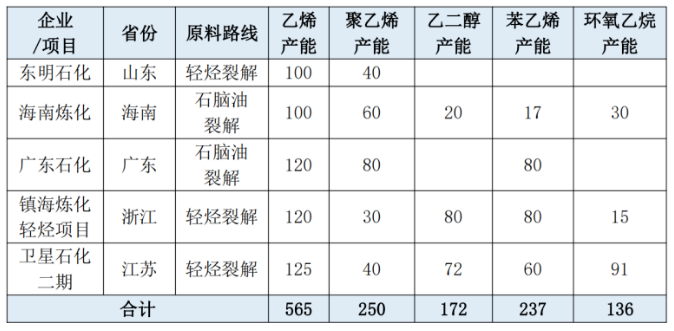

The CNPC Economic Research Institute predicts that China’s new ethylene production capacity will still reach 5.65 million tons/year in 2022, and the total production capacity will increase to 49.33 million tons/year, which will catch up with or surpass the United States. Among the newly added production capacity, gas-based ethylene continued to develop rapidly, accounting for 61%, which was higher than the production scale of oil-based ethylene.

In 2022, domestic new ethylene production capacity is expected to be 10,000 tons/year

Source: CNPC Economic Research Institute

After 2022, domestic ethylene capacity expansion will continue to expand, but capacity growth will slow down compared to 2020 and 2021. From 2023 to 2025, there are still a large number of ethylene projects put into operation in China, and the total ethylene production capacity with a high probability of operation is 16.4 million tons/year. Among them, oil-based ethylene will account for the vast majority; the new capacity of gas-based ethylene will face greater uncertainty, mainly due to the stability of overseas ethane supply; the scale of new coal/methanol-based ethylene capacity will be relatively limited, mainly As the provinces have successively introduced production capacity control policies in the coal chemical industry and other industries under the “dual carbon” goal.