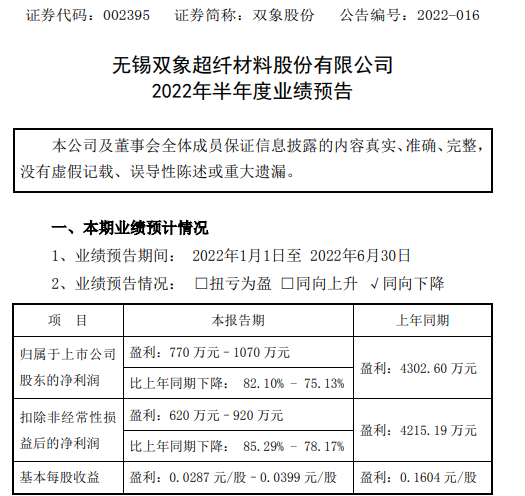

Latest News: Double Elephant recently released the 2022 semi-annual performance forecast. During the reporting period, the net profit attributable to shareholders of the listed company was 7.7 million yuan – 10.7 million yuan, a decrease of 82.10%-75.13% over the same period of the previous year. %; basic earnings per share is 0.0287 yuan/share – 0.0399 yuan/share.

The net profit in the first half of 2022 has dropped significantly compared with the same period of the previous year. The main reasons are: First, during the reporting period, due to factors such as the new crown epidemic, the prices of raw materials such as methyl acrylate (MA) rose sharply, resulting in the company’s PMMA products. Gross profit margin decreased; secondly, during the reporting period, the parent company had stopped production due to demolition, while the wholly-owned subsidiary Chongqing Shuangxiang Microfiber Material Co., Ltd. was in the trial production stage, and its production capacity was gradually being released, resulting in less contribution to performance.

According to the data, the main business sectors of Shuangxiang Co., Ltd. are artificial leather and synthetic leather business sector and optical grade PMMA business sector.